I. The number one excuse to delay your estate plan is that

Your Family is Crazy.

It’s the lunatic non-fringe that delays estate planning.

You wills and trusts lawyer in sunny San Diego is sorry to say it, but your family is crazy. They all are. As a matter of fact, the word “family” derives from the Latin, insanit et familiae (literally: “insane is family”). Due to a typically-brief Roman lifespan that favored conciseness, it was colloquially shortened to familiaea (before simply becoming “family” in the modern tongue).[1]

Over four decades of estate planning experience, your living trust attorneys in San Diego have witnessed many changes to the wills and trusts field.

Yet, the fact that your family’s whack has been a constant feature of San Diego estate planning law. The problem craziness creates is that it begs the question: who do you appoint to carry out your wishes? Who will manage your will, living trust, power of attorney and advance health care directive, the docs your faithful estate planning lawyer puts together?

II. Get Your Estate Plan Started and Why Keanu Reeves Matters

Hi, I’d like to set an appointment for my family’s living trust. 8am? Anything earlier? I’m up at 5 and ready to go!

When you call your estate planning lawyer, he’ll explain with line-by-line instruction what you need to get your living trust started. There isn’t any guesswork.

There are many taxing tasks in the estate planning client’s life: sealing supposedly re-sealable bags bought in Costco-sized bulk, knotting the Windsor necktie knot (not to mention non-clip-on bowties), selecting the best ice cream flavor… but the living trust attorney call to kickstart the process isn’t one of them.

Yet, Alas! Your estate planning lawyer cannot do it all. It’s up to you, the estate planning client to assign the “functionaries” to carry out your estate plan (if you are incapacitated or upon death), including a successor trustee to administer your trust, executor of your will, attorney in fact (holder of power of attorney) and agent for your health care directive.

In assigning these roles (and despite herself), the living trust client routinely looks first to insanitae familiaea.

Read More: Who’s Who in the Estate Plan: Who’ll Manage Your Trust When You’re Gone

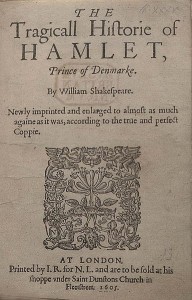

Now before it moves on, your living trust attorney blog brings you this moment from blockbuster film history:

Though not as thrilling as seen In the above seminal scene from the now-twenty-year-old(!) flick, Speed (twenty years–how time flies with such, ahem speed) selecting one’s fiduciary (entrusted) peeps for the estate plan likewise begs the question

What do you do? What do you do?!

III. Choosing Who You Trust for the Revocable Living Trust

Thus, the estate planning client wonders:

Whom do I appoint to respectively carry out my will, living trust, power of attorney and advance health care directive?

My nutty sister, Sue or slightly-less-nutty brother, Bo?

Bonkers Aunt Bea or Goofy Uncle Gary? [2]

And a litany of others from the rogues gallery we call family.

Gasp! Is this estate planning dilemma insoluble?

No! Read on, Living Trust Attorney Blog Reader!

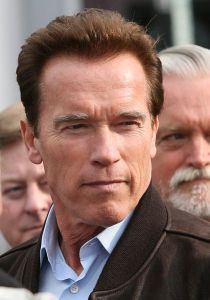

IV. The Estate Plan and Arnold Schwarzenegger: Why there are only two choices.

The estate planning client has stalled upon the question: whom does he assign to handle finances when he is incapacitated & upon death? The San Diego living trust lawyer boils it down to two choices:

1. Put it off.

You’d rather not decide the lesser of “evils.” In casual conversation, you mutter,

A living trust? Yeah, I gotta get one of those.

Does Ah-nuld have an Estate Plan? You betcha. Even if you have non-Schwarzennegarian-level assets (but have a modest home and financial affairs to manage), you need an estate plan.

And then… it never comes to be. But, God forbid, something happens. Then what?

Who will manage your financial affairs and health care if you cannot? Who will inherit (and who will not)? Who will manage your estate when you’re gone? Whom do you prefer to care for your kids?

Do you reckon the State should answer all that? Listen to me now, believe me later: even the Austrian Oak, governator emeritus sworn to the Golden State wouldn’t stand for it. Nein!! Nimmer! Cali-fonia vill not deciiide!

The passive approach won’t do, no it won’t. Not having an estate plan will leave your loved ones with undue confusion and costs that will compound their grief.

You could argue that that would be their own fault… it’s THEIR insanity that stymied your trust. Or you could stop being silly and rationally choose option 2, which is:

2. You deal.

In the end, you must decide… to decide. You’ll go with slightly-less-nutty brother. Or not. But choosing nothing instead of something ideal is throwing out the estate-plan baby with the crazy-family water.

We live with uncertainty. What if you make the wrong choice? Well, my friend: you are going to take that risk and rest assured: what we create are living, breathing estate planning instruments. The revocable living trust is, well revocable. And amendable. If cuckoo-sister Sue someday gets a clue, you can accordingly revisit your living trust at low cost.

There you go. Crazy family is here to stay. But so is the need to plan your future today (and pray that slightly-less-nutty brother or regular-nutty sister see the light).

To schedule a free, no-obligation consultation with our San Diego Wills and Trusts Attorney, Asaph Abrams:

- Call: (619) 261-0489

- Email: abramslawsd@gmail.com

- Or complete the form on our Contact page.

___________________________

[1]

The more cunning of linguists might posit that this theory is blatantly false.

Disclaimer (say it über rapidly like the radio admen do): the attorneys at the Law Office of Asaph Abrams specialize in estate planning: wills and living trusts. As to etymology of Indo-European languages, opinions may possibly be purely speculative flights of estate planning lawyer fancy.

Back

[2]

Apologies to all Sues, Bos, Beas and Garys. Ed.

Back

Photo Credit (Arnold Schwarzenegger): Bob Doran; Creative Commons usage. – Man of Tai Chi 07 CC BY-SA 2.0.